How Savvy Marketers Harness Social Data for Product Development

Posted: May 14, 2012

You should be using social media to help with decisions about product development. Consumers are talking about products – both the good and the bad – on social media. Be one of the forward-thinkers and use their feedback to your advantage.

[caption id="attachment_10105" align="alignright" width="194"] © Rafal Olechowski - Fotolia.com[/caption]This is a guest post written by Gini Dietrich, founder and CEO of Chicago-based integrated marketing communication firm Arment Dietrich, and Geoff Livingston, an author and marketing strategist who serves as VP, strategic partnerships for Razoo. Gini and Geoff are authors of the new multichannel marketing book, Marketing in the Round.

© Rafal Olechowski - Fotolia.com[/caption]This is a guest post written by Gini Dietrich, founder and CEO of Chicago-based integrated marketing communication firm Arment Dietrich, and Geoff Livingston, an author and marketing strategist who serves as VP, strategic partnerships for Razoo. Gini and Geoff are authors of the new multichannel marketing book, Marketing in the Round.

Online, we often talk about listening to our customers on social channels to help make content decisions in marketing. Moving to a fully integrated marketing picture for enterprise, using social media to compliment traditional market and product development research only makes sense. The very nature of uncontrolled conversations empowers customers to communicate and yield unthought-of insights and new product directions.

However, most companies are still at the basic point of simply making Facebook and Twitter work, much less mastering content for marketing or social web-wide conversations. In fact, last autumn’s Global CMO Study from IBM confirmed that most enterprises just aren't there yet.

Consider these findings:

- While 82% of CMOs plan to increase social media use during the next three to five years, only 26% are currently tracking blogs, 42% are tracking third-party reviews, and 48% are tracking consumer reviews to help shape their marketing strategies.

- 56% of CMOs view social media as a key engagement channel, but they still struggle with capturing valuable customer insight from the unstructured data that customers and potential customers produce.

If you're one of these companies, you might be wondering how to move beyond the intricacies of community management and inbound marketing to become a company that harnesses social data to drive strategy and product marketing.

The process can be broken into two main areas: 1) building listening stations and dashboards on relevant topics, and 2) sifting through the data to find actionable intelligence.

To help illustrate these two critical areas, we asked two friends, one from a large enterprise and one from a small enterprise -- Richard Binhammer at Dell and Danny Brown at Jugnoo -- to open their corporate kimonos and show us how they do it.

Dell: An Overview

Dell’s work with Ideastorm as a crowdsourced marketing intelligence center is legendary, leading to almost 500 implemented products. Going further, as one of the first social enterprises, Dell’s Social Media Listening & Command Center does more than just seek out Dell conversations to comment on. It also drives relevant reporting throughout the enterprise for strategy and product marketing decisions.

Jugnoo: An Overview

In the past two months, Jugnoo (a social business platform) used social media intelligence to drastically change its JugnooMe social automation platform’s front end. Changes included the addition of features such as social search/monitoring for brand reputation purposes (including sentiment analysis).

By listening to its users and making product changes, Jugnoo saw:

- 270% increase in registrations from JugnooMe v1.0 to v2.0 in just one week

- 200% increase in toolbars installed

- 225% increase in social posts

- 333% increase in keywords

Build Listening Stations and Dashboards on Relevant Topics

As the IBM study shows, less than half of companies are listening to relevant conversations about them online. Those that do have built comprehensive social media dashboards to see where the conversations are happening, measure social media marketing results, gauge sentiment analysis, and respond intelligently.

As the IBM study shows, less than half of companies are listening to relevant conversations about them online. Those that do have built comprehensive social media dashboards to see where the conversations are happening, measure social media marketing results, gauge sentiment analysis, and respond intelligently.

The first critical step in harnessing larger market intelligence is expanding those listening stations to include more topics to drive strategic and product marketing intelligence. For example, add relevant searches and conversation monitoring for competing products, core industry topic areas, significant competitive developments (hires, funding, etc.), key customers, and of course, conversations about your product offering.

Consider that Dell monitors more than 25,000 posts about the company every day, up 21,000 since 2006. Centralized “listening” via Dell’s social media listening command center is critical to keeping an eye on the big picture and overall social media commentary. This intelligence is divvied up into a wide variety of reports that inform the company as a whole and its consumer, small and medium business, public sector, and large enterprise and services business segments.

Dell actively listens to its competitors’ conversation and how they impact larger macro issues. “We look at what the [competitive] conversations are about as related to our business,” says Binhammer. “This includes the conversations about competitive products and services, industry issues, and individual competitors.”

Similarly, Jugnoo has also added competitive intelligence into its online social media listening process. “The only way we can grow and improve is to see what our competitors are doing well, and how we can improve on that,” says Brown. “There’s no point in just copying – you need to improve, or at the very least integrate your product suite where your competitors may not. Companies like Hootsuite and Traackr are doing an awesome job – these are the guys we look to for best practices and where we can take our products to the next level of their benefits.”

Sift Through the Data

Using relevant conversations about your product, industry topics, and competitive offerings can provide a composite picture for your marketing roundtable and the larger executive team. In many ways, when you open the floodgates and listen to more conversations about a much wider group of data points, qualifying relevant information becomes critical. A company needs to learn not only how to listen, but also which data points to act on.

Every customer’s positive, neutral, and/or negative feedback about industry offerings is important. But repetition and general sentiment trending about product topics and service issues can provide quick touchpoints for the marketing and executive teams to make decisions.

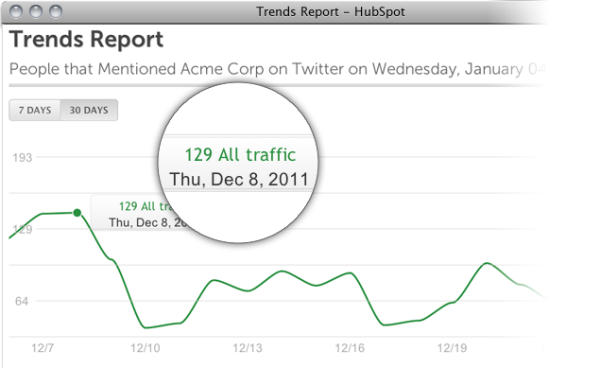

When harnessing the new data, try to visualize it using charts, graphs, maps, and other visualization techniques. Let the pictures tell you what the top customer and product trends are.

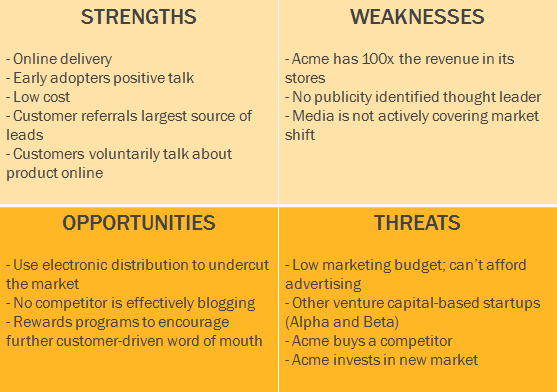

If you're struggling to figure out how to deliver this information, go back to marketing basics. Another method is to analyze competitor moves and offerings in the context of a traditional strength, weakness, opportunity, and threat analysis (SWOT). Simply present your social data within this commonly accepted framework. Just a refresher on a SWOT analyses:

- Strengths: What internal assets or behaviors give your business an advantage in the marketplace?

- Weaknesses: Which internal defects and issues can prevent you from succeeding?

- Opportunities: Are there external factors you can take advantage of?

- Threats: Who and what can stop your business from succeeding?

A Traditional SWOT Analysis

Your company has an objective—it might be a specific initiative with a product, or it might be general market performance for the year. That objective is the focus of your SWOT analysis. State it clearly, and keep it in mind above all else when writing your SWOT report. While social data trends can be fascinating, if they are off-topic, they probably are irrelevant. It’s important not to become distracted by shiny objects and to stay on mission.

Once you have developed your social marketing intelligence report for the larger marketing and executive teams, you can put it to good use.

“Because we’re a start-up where every team has access to the other, and we work in a cross-team development, [social intelligence] affects every part,” says Brown. “Feedback from our customers is relayed to customer service and our retention team, who in turn meet with the product team. Product analyzes then meets with Development, who then work with R&D to determine the feasibility of new feature requests and new technology based on user trends, etc."

“These then get mocked up, approved by Product and Marketing, developed, and released into our platform,” Brown continued. “Our beta users then get to use, test, and offer more feedback, and then determine whether a product update stays and makes it to the public platform due later this year.”

Dell provides a series of daily, weekly, and monthly reports based on its social intelligence. Reports cover specific topical or announcement daily reports looking at the size, sentiment, locations, who was leading the conversations, etc.

“On a daily basis, we report and assess the top-moving topics in social media related to Dell (positive and negative),” says Binhammer. “We identify critical product and service issues and have a weekly review of these. We also have an in-depth monthly report on key findings across the social Web."

“We find our listening and tracking of information on the web is often a 'leading indicator' of a product issue that requires our product teams’ attention, such as the need for a new driver or software fix on some hardware issues that emerge over time,” added Binhammer. “A team follows through on these issues to bring the various parts of our business together to solve things. This fosters Dell’s being more closely connected to customers and constantly in touch in order to be a better business.”

Biz Tip Provided by HubSpot Blog

Biz Tip Provided by HubSpot Blog

Posted by Pamela Vaughan